Can You Right Off Nails Expense If Doing Pampered Chef

This postal service may contain chapter links. Read my full disclosure policy here.

Y'all know what'southward crazy?

For all my honey of numbers, I hate taxes. Only the thought of gathering all that paperwork, trying to mess with software, and crossing my fingers that I did everything correct and won't owe a cent, makes me pause out into a common cold sweat — no joke!

Equally we've added a rental property in a unlike state, Joseph's real estate gig, and my ain blog-turned-business concern, the more complicated our taxes take become. I wish I could just hide under the covers until April 15, but Uncle Sam probably wouldn't like that too much.

Despite every excuse known to mankind, I finally sabbatum downward and forced myself to do a ton of reading and research on all things small business and taxes this year, and while I am not a tax professional, I learned a lot. But rather than keep all this information to myself, I figured it might be helpful to share my findings with those of you who likewise work-from-home.

Considering whether yous own an Etsy shop, sell products through a direct sales company like Mary Kay or Pampered Chef, or even take on a few side jobs decorating birthday cakes for friends and friends of friends, you lot want to make sure your business is on the upward-and-up, no matter how confusing the taxation code might be. It's non only ethical, it's only smart!

I have tried very hard to pause downward and bring you the most of import tips, and will be updating this post equally things change.So bookmark it, pin information technology, or tuck information technology away in your email to reference when y'all need it virtually. And brace yourself, considering it's a little on the long side — deplorable!

ane. Know How You Should File

There are a ton of filing or "classification" options to consider when y'all offset a business. Are you lot a sole proprietorship? An LLC? A Corporation? There'due south pros and cons to all of these, and nosotros're not going to cover all of them today, but hither's pretty much what you demand to know:

- If your internet income {after all expenses}, is $400 or in a higher place, so congrats! You're in business organisation. The best option for you is to starting time as a sole proprietorship and file a Schedule C in addition to your personal taxes. Virtually minor businesses start out this manner, and information technology is the easiest, and less painful route to go.

- If your internet income is, or expected to be to a higher place $10,000, y'all may want to consider a unmarried-member LLC. This separates your business assets from your personal so you are protected in case of a legal battle. You also file a Schedule C in add-on to your personal taxes and you lot'll have to pay self-employment taxes on top of everything else. This cost can get pretty hefty if you start making even more money.

- If your net income is, or expected to exist $20,000 or above, y'all will probably want to classify your LLC as an S-Corp. This requires a lot more paperwork, just y'all don't pay self-employment taxes. Instead, you put yourself on the payroll, and simply your wages are subject to employment taxation.

There are, of class, a few more means you lot can file, merely for small business owners and freelancers, these three are the most common, and certainly less confusing!

two. Go on Good Records

Everyone always stresses that you need to continue a really detailed set of books when you ain a business, merely they don't necessarily explain what you demand to include. You exercise not, under whatever circumstances, want to hand your CPA a shoebox full of crinkled receipts or I tin can guarantee yous'll literally pay for it!

At the very least, y'all'll desire to continue track of income and expenses. I use a simple spreadsheet for this, but if you'd like something a little bit more than structured, I would strongly suggest a software like Quickbooks, which integrates seamlessly with TurboTax.

I currently use Quickbooks Online and it is super super easy to use. The learning curve is practically nil for the computer-savvy, and the ability to import all your transactions automatically is and so handy!

In addition to some sort of tape keeping system, it's also expert to keep track of all your paid invoices and expense receipts. Everything I am paid, or pay out, is printed, hole-punched and filed abroad in a iii-ring binder with an receipt or invoice number written across the top. Or, you can do everything digitally through Evernote.

three. Don't Ignore Quarterly Taxes

Even if you lot don't think yous volition make very much {or owe for that matter}, it is however very important to pay taxes on your income every quarter. Note: I did not exercise this for 2014, and as a outcome, faced a rather large bill when information technology came time to submit my taxes!

Well-nigh taxation professionals suggest setting aside anywhere from 20-30% of your income to pay in taxes on grade 1040-ES each quarter. Still, if yous file as an S-Corp, y'all would need to send in all payroll taxes and payments via Form 941—depending on how much you make, this could be every month or every quarter.

One mistake I made as an S-Corp was to ignore Land Unemployment Taxes. But yous have to pay those besides, and they get filed every quarter along with your 941. At the cease of the year, the government volition go their share on Class 940.

Ay yi yi….almost makes you Not want to exist in business, right? Don't worry, you lot'll get through this!

12/22/fifteen Update: If you file equally an S-Corp and also pay health insurance out of your own concern, yous must add the full corporeality of your almanac premium to Line 2 on your Quarter 4 941 forth with the wages yous earned. However, you do NOT need to count that as taxable. The regime just needs to meet that y'all paid information technology so you tin deduct it on your twelvemonth terminate tax returns. I know that doesn't sound like information technology makes a whole lot of sense, but co-ordinate to my CPA, it'south the way the regime wants your health insurance recorded from now on.

4. Don't Forget about 1099's

As your business grows, you may find yourself paying an assistant to help out, or you might accept a one-fourth dimension project that you need done for a set fee. This is called contract labor, and you need to issue a 1099 (Miscellaneous Income) at the end of the year to everyone who you lot paid over $600. 1099's are pretty easy to fill out, only they practice require your helper to sign a Westward-nine with all relevant information.

Equally you receive coin from various businesses, yous will probably receive a 1099 besides. Report all of these on your taxation forms {plus any other income} then as to eliminate whatever red flags. Every time a 1099 is filed on 1 end, the IRS looks for an expense on the other. They need to balance each other out, otherwise, you'll take someone official poking around request questions!

Note: 1099'south need to be issued and sent before January 31st.

v. Take Advantage of Deductions

Deductions are really just some other fancy term for expenses, and claiming them on your tax render will lower the corporeality of income you lot are taxed on, which ways you will owe the government less money — win!

One of my favorite deductions is the mileage deduction. Many concern owners (including me in the past!) discount this deduction because it seems too complicated to proceed track of. Simply it's actually really easy in one case you lot know what to do, especially if you take reward of this easy to employ mileage log.

For an exhaustive list of what you can deduct as a small business, I establish A Freelancer'south Guide to Taxes really helpful. This mail service takes you line-by-line through Schedule C and so you actually understand what expenses to put where.

However, a somewhat gray area in the realm of deductions has to do with the "business concern utilise of your dwelling."Your Blogging Concern: Tax Talk and Tips from a Bookkeeper Turned Blogger by Nikki Hughes has the all-time explanation of this I've seen then far, and her book is a pretty good resource every bit a whole for everyone who owns a small business organisation, non just those in blogging. Definitely cheque it out!

six. Depreciate Your Equipment

Depreciation of equipment sounds similar a term that only high paid CFO'southward use, but fifty-fifty if yous're a small business owner, you lot probably use a laptop to connect with customers, a camera to accept product photos, and office furniture to use and sit on while you're doing your work.

The IRS allows you to depreciate all of these items over a catamenia of time {unremarkably v-7 years} to help lesson your taxation liability fifty-fifty further — meaning, that's less you lot have to pay in taxes — another win!

You lot should use Form 4562 to summate depreciation, just if you lot are unsure how to practice it yourself, I would highly suggest you talk to a CPA about it to figure exactly what you lot can depreciate and by how much. The book I mentioned in a higher placeas well has a good overview of depreciation and how information technology works.

7. Don't Be Afraid to Hire a CPA

This leads me to my concluding point — if taxes actually make y'all break a sweat, information technology's okay to hire a CPA. In fact, information technology's recommended!

You lot don't want to get yourself into trouble because of silly mistakes. Despite there being bully software out in that location that can aid guide you through the procedure, taxes are such a complicated mess. And because CPA'south know the tax lawmaking inside and out, they can help you file in such a way that benefits you lot.I've heard many a horror story about small business concern owners who effort doing taxes themselves, and end upward owing a lot more than than they probably should have.

However, a CPA is not a crutch, and as a small business owner, you need to exist aware of at least some of what goes into the tax filing process so y'all know exactly what to go on runway of. This ever makes it much easier for the CPA to practise his job for you lot, which ways less hours he'southward working on your return, and the less y'all accept to pay for it.

Whew — that was quite the postal service — but you made it!

Even though taxes are not necessarily a fun topic to discuss, ignoring them won't make the situation go away. Information technology's your responsibility to do your homework and understand your taxation liability no affair how much you lot earn. Uncle Sam won't be quite every bit forgiving if y'all don't!

Equally I mentioned at the beginning of this post, I am not a tax professional, and then everything I say here is not gold, so please do not take it as such! These are simply the takeaways of what I have learned in the few years I've been doing business.

That being said, I am open to any and all questions well-nigh small business taxes you accept in the comments, and if I don't know the answer, I'll find someone who will!

Exercise you own a small business?

How exercise you handle taxes?

– – – – –

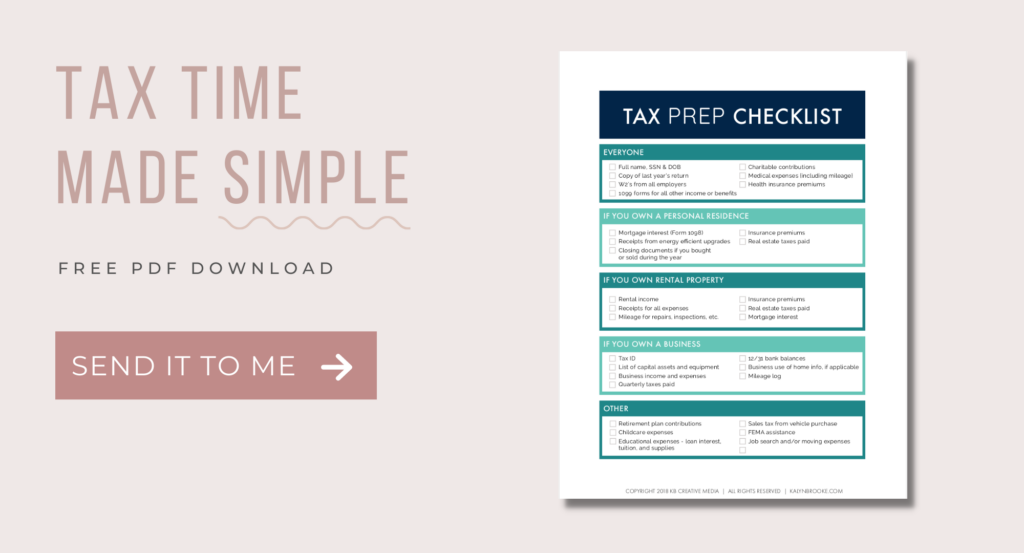

Tired of forgetting of import tax documents?

Disclosure: Some of the links in the postal service in a higher place are affiliate links. This means if y'all click on the link and purchase the item, I volition receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

Source: https://kalynbrooke.com/business-blogging/small-business-tax-tips/

Posted by: kingwhooksgivem.blogspot.com

0 Response to "Can You Right Off Nails Expense If Doing Pampered Chef"

Post a Comment